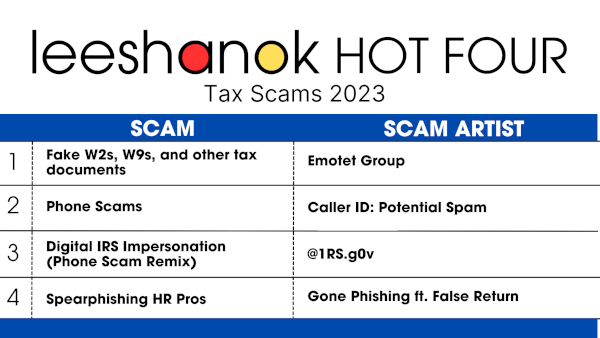

Billboard has their Hot 100 list of best-selling songs. LeeShanok has the Hot 4 tax scams for 2023. With the April filing deadline just around the corner, now is the time to be on high alert!

Some of these scams are certified classics, others are new, chart-topping hits.

LeeShanok’s Hot Four Tax Scams 2023

AI tools make cyberattacks more accessible to more people in two key ways:

- Fake W9s, W2s, and other docs – These new scam artists have a unique spin on an old favorite. A current attack is using Microsoft One Note documents labeled “W9 tax form.” Once opened, the document tricks users into enabling macros, which allows the malicious script to run.

- Phone Scams – A true oldies classic for tax scammers. The threat actor calls the victim on the phone pretending to be an IRS agent. They demand your personal info or payment of your overdue taxes (often via gift cards).

- Digital IRS Impersonation – A remix of the classic phone scam, scammers claim to be from the IRS over email, text message, or social media. Remember, the IRS never sends unsolicited emails!

- Scams Targeting HR – The HR Genre is filled with scam artists trying to make it to the top. Hackers send targeted spearphishing attacks to HR seeking W2s or pretending to be employees updating their direct deposit info. They use this info to file fake returns, collect tax refunds, or reroute pay checks.. All IRS-related phishing can be reported directly to the IRS.

Join our Multi-Platinum Lunch and Learn!

OK, maybe we haven’t sold millions of recordings of our webinars, but the information is still top-notch!

You and your team are invited to our next lunch and learn, Optimizing Security on Mobile Devices! Avoid hackers and scammers, even while on the go!

Date: Thursday, April 27th

Time: 11AM – 12PM

Location: Virtual

Topics Covered:

- App Security

- Spam Calls

- Mobile Phishing Prevention

- Lost/Stolen Devices

- & More!